Industry Analysis 2025

Insight fuels instinct.

This is where I connect market signals to creative choices.

Market Trends Overview

Two currents define 2025. First, a correction from “Peak TV” to fewer but more carefully positioned originals. Second, growing audience time on streaming and social video that rewards concepts with clear hooks and strong repeat-view value. This environment favors projects that balance specificity of voice with clarity of premise.

Why this matters for development?

Fewer greenlights mean every logline must carry immediate intent. Packaging and audience fit are as critical as premise. Library strength and completion rates influence renewals, so series need durable engines, not only pilot sparkle.

US Original Scripted Series Counts

Source: Reuters, Lisa Richwine, Feb 10, 2024

Audience and Demographics

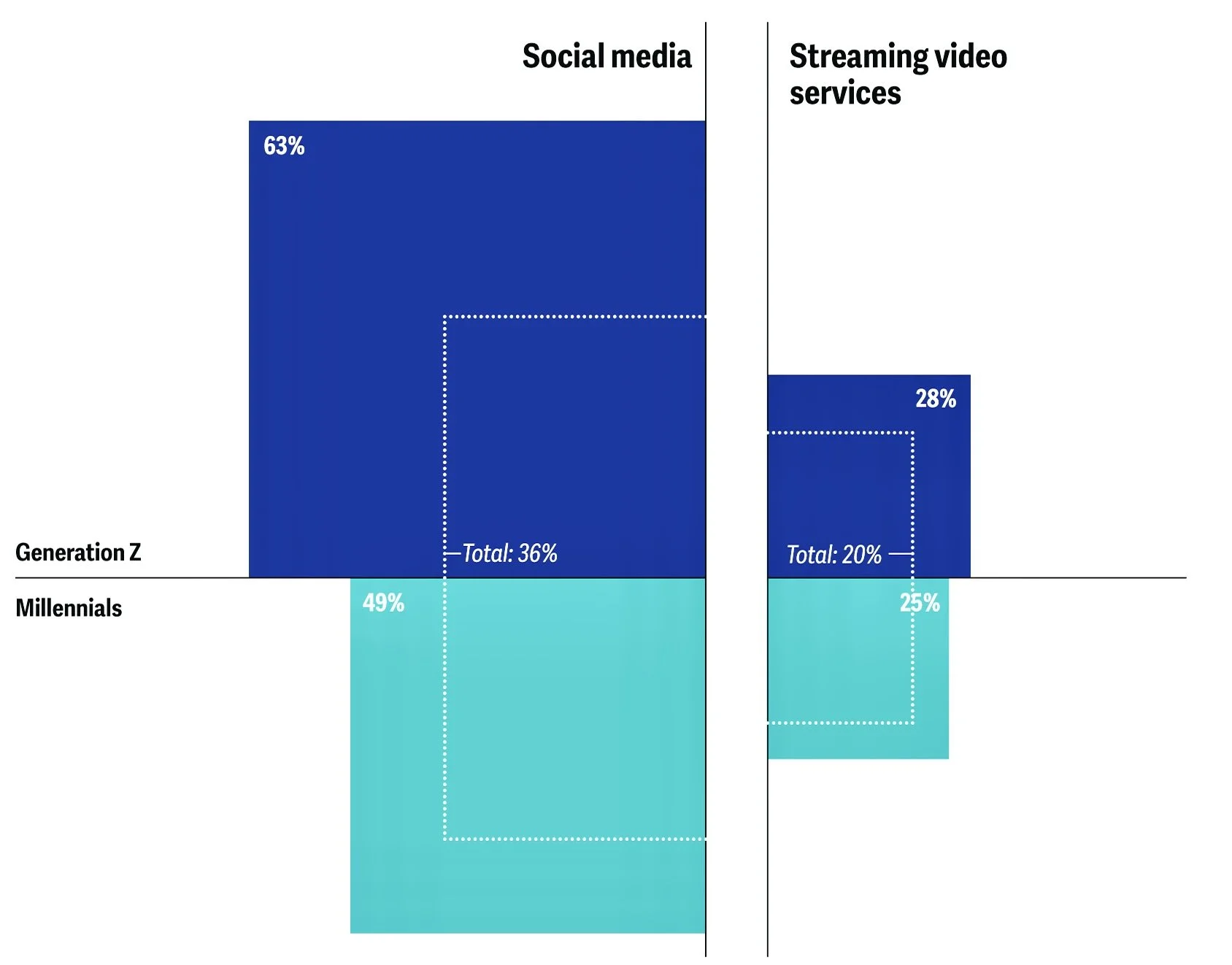

Gen Z and Millennials spend more time with short-form and creator video, and a meaningful share say social content feels more relevant than traditional TV and film. This does not replace long-form storytelling, but it raises the bar on velocity of engagement and community-building around shows.

Implications for development

Lead with concepts that generate immediate conversation, modular beats, and moments that travel well in clips. For older demos, prestige craft and finite runs continue to perform when the thematic promise is clear and execution is disciplined.

Gen Z + Mellenial Media Signals

Source: Deloitte, Digital Media Trends 2025

Competitive Landscape

Different platforms lean into distinct identities and economics. Company-level viewing share in August 2025 shows YouTube leading overall TV watch-time in the US, followed by Disney and Netflix. This mix underscores how sports, live, and creator ecosystems can shift share at the company level while SVODs optimize release strategies, budgets, and IP.

Insight Positioning

Apple TV+ remains a quality and curation brand. Packages that communicate “premium yet broadly human” sit naturally here, especially if the concept scales internationally without losing intimacy.

Opportunities and Gaps

US demand shares show an enduring appetite for drama, with meaningful interest in reality and documentary. The opening is not “more of everything,” it is better balance: emotional specificity with cost control, and formats that encourage return viewing.

Where to lean in

Character-first genre pieces that deliver propulsion with contained worlds. Premium documentary and hybrid doc-series with clear true-crime or curiosity hooks. Smart comedy with distinct tone and short season orders. YA that is more grounded than VFX-heavy fantasy, designed for community and clip-ability.

Takeaways for Development

I prioritize concepts where human drama meets a clear high-concept promise. Every project must answer three questions: who shows up on day one, why they return on day seven, and how the story sustains season over season. I develop for clarity of hook, durability of engine, and emotional truth. That alignment gives a platform like Apple TV+ cultural weight without volume.

Final Note:

In May 2025, streaming hit a historic milestone: 44.8 % of total U.S. TV viewing time, surpassing the combined share of broadcast and cable. But the battle is no longer just about share — it’s about what keeps audiences from leaving. Development decisions now live or die on retention, global resonance, and cultural stickiness — the true battleground for the next era of entertainment.